A unique solution to your company’s spiraling healthcare costs

Currently 72% of American companies are covered under self-funded health insurance plans. That’s 92 million American workers, with more switching every year.

Is a self-funded health plan administered by MagnaCare right for you?

Let’s compare

The traditional model

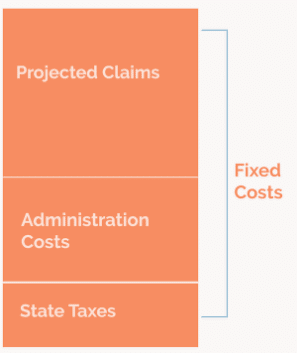

Companies hire health insurance companies to provide fully insured healthcare for their employees. But companies have little control over the healthcare benefits provided or any ability to halt rising premiums. According to a 2020 Kaiser Family Foundation report, the average premium for employer-sponsored family health coverage increased 22% over the past 5 years and 54% over the past 10 years.

Self-funded model

A self-insured health plan is one in which your company assumes responsibility for providing healthcare benefits to your employees. Your company sets up a fund for your employees’ healthcare claims and hires a third party administrator (TPA) like MagnaCare to administer it.

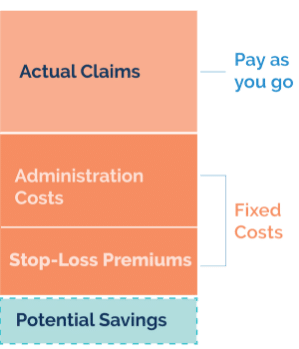

Self-funded plans reduce your overall costs, immediately saving you 2 to 3% on the cost of the plan, with the potential to save far more. Self-funded plans are also preempted by ERISA from paying state mandate costs.

You save money when eligible medical claims for a year do not exceed your plan’s predetermined limit.

With a self-funded insurance plan, your company can keep those dollars to offset the subsequent year’s funding.

Under a fully insured plan:

Under a self-funded plan:

Third Party Administrators work for you

TPAs like MagnaCare work with the help of their actuaries to assist you in determining the level of coverage you need. Unlike traditional insurance companies, they don’t drop or reject claims or make arbitrary plan changes. It’s in their best interest to clear up red tape — a chief employee complaint about traditional insurance — rather than create it.

Why MagnaCare?

Providing exceptional value, experience and flexibility, MagnaCare leads the way in controlling healthcare costs and shaping benefits for companies across the nation.

Ready to talk it over? We’re ready too.

Get in touch and get a third-party administration partner you can rely on.

Call 888.799.6465 or fill out the form below

Partner With Us

Related Articles

MEC Plans vs. Major Medical Insurance: Understanding the Differences

Choosing the right health plan for your organization…

The Role of Utilization Management in Self-Funded Health Plans

n today’s healthcare landscape, controlling costs while maintaining…